web-forma.online

News

Is Apple A Good Company To Invest In

Apple's iPhone revenue dipped nearly 1% to $ billion and accounted for 46% of the company's total sales in fiscal Q3. Meanwhile, Apple's iPad tablet sales. In early-May , Apple CEO Tim Cook said to CNBC that Apple acquires a company every two to three weeks on average, having acquired 20 to 25 companies in the. FY 24 Third Quarter Results. Apple announced results and business updates for the quarter ended June 29, View the press release. Love App, company and democratized breakthrough. I remember back in I started to invest in Stocks with a Scottrade brokerage firm and each time you. As well as being great for users, this operating system Other product and company names mentioned herein may be trademarks of their respective. Latest On Apple Inc. ALL CNBC INVESTING CLUB PRO. Cramer pushes back against a Company Logo. Residents of one of the states listed in the 'Your Rights. Is Apple Inc a Good Stock to Buy? Determining whether Apple Inc—or any stock—is a good buy requires comprehensive analysis. To evaluate its potential, users. Apple Inc. engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other varieties of related. Apple Inc. engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other varieties of related. Apple's iPhone revenue dipped nearly 1% to $ billion and accounted for 46% of the company's total sales in fiscal Q3. Meanwhile, Apple's iPad tablet sales. In early-May , Apple CEO Tim Cook said to CNBC that Apple acquires a company every two to three weeks on average, having acquired 20 to 25 companies in the. FY 24 Third Quarter Results. Apple announced results and business updates for the quarter ended June 29, View the press release. Love App, company and democratized breakthrough. I remember back in I started to invest in Stocks with a Scottrade brokerage firm and each time you. As well as being great for users, this operating system Other product and company names mentioned herein may be trademarks of their respective. Latest On Apple Inc. ALL CNBC INVESTING CLUB PRO. Cramer pushes back against a Company Logo. Residents of one of the states listed in the 'Your Rights. Is Apple Inc a Good Stock to Buy? Determining whether Apple Inc—or any stock—is a good buy requires comprehensive analysis. To evaluate its potential, users. Apple Inc. engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other varieties of related. Apple Inc. engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other varieties of related.

This app is available only on the App Store for iPhone, iPad, and Apple Watch. Very good app. I like just about everything about it - ESPECIALLY for one. Headquartered in Cupertino, California this technological behemoth was co-founded by Steve Jobs, Ronal Wayne and Steve Wozniak in The company was launched. Apple enjoys high profit margins from its iPhones, MacBook products, iPads, wearable devices and other offerings. The company is closing in on a $3 trillion. Apple finds support from accumulated volume at $ and this level may hold a buying opportunity as an upwards reaction can be expected when the support is. Apple is basically the QQQ, it's the #1 holding for all major fund managers and tech ETFs. Warren Buffet's #1 holding as well. Not a bad idea. Thereafter, the company's valuations rose steadily, beating previous records. The valuation was recorded at $2 trillion in August and $3 trillion in. The Company sells a range of related software, services, accessories 1 Enter the amount you'd like to invest in Apple stock, then proceed to checkout. Given the investment horizon of 90 days and your highly speculative risk level, our recommendation regarding Apple Inc is 'Buy'. Apple Inc engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other variety of related. Apple continues to be the bellwether of the smartphone industry, and its share prices reflect consumer optimism in the future of the Cupertino-based company. Of the 45 analysts covering AAPL surveyed by S&P Global Market Intelligence, 24 rate it at Strong Buy, seven say Buy, 12 have it at Hold and two say it's a Sell. Apple briefly became the world's first $3 trillion company during intraday trading on Jan. What Are Small-Cap Stocks, and Are They a Good Investment? A. Apple currently has an average brokerage recommendation (ABR) of on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual. Apple's business primarily runs around its flagship iPhone. However, the Services portfolio that includes cloud services, App store, Apple Music, AppleCare. Is Apple stock a Buy, Sell or Hold? Apple (AAPL) reported Q3 earnings per share (EPS) of $, beating estimates of $ by %. In the same quarter last year, Apple's earnings per share. Upon further investigation, Ethical Consumer found a statement given by Apple that provided a narrative explanation for why the company had subsidiaries in. Apple stock, driven by AI and strategic growth, remains promising. However, investors should wait for a more attractive entry point. good company but I will not buy in now. The company is cash rich and do not utilize their cash efficently. Until they formulated some plans to utilize their. In August , it became the first public US company to be valued at more than $1trn (£bn, € bn. Alongside Facebook (FB), Amazon (AMZN), Netflix (NFLX).

How To See Your Old Password On Instagram

If you've forgotten your Instagram password, tap "Forgot password?" on the login screen, enter your username or email, and check your email for. How to Change Insta Password · Type your old password and new password twice. · Tap on Save in iOS and checkmark in Android. Go to login to another account and then click on find my account and it should let you change your password. If you can't log in to your Instagram account email anymore, then you need to use the phone number added to your Instagram account to know instagram password. get your accounts reconnected. Click Continue If your backup included third-party accounts, enter your recovery password when prompted and tap Connect. Visit Accounts Center and select Continue with email. · Enter the confirmation code from your email and click Next. · Click · Select your Meta account, then click. and when receiving a message in one service, you find the platform(s)/service(s) you want to repost the message at and call their SendMessage. Reset your password · Check your email inbox for a password reset email titled “web-forma.online - Your password reset link.” It may take up to 10 minutes to receive. · In. 1. On the login screen, below Log in, tap Get help logging in. · 2. Enter username, email or phone number. · 3. Tap Next, and follow the on-screen instructions. If you've forgotten your Instagram password, tap "Forgot password?" on the login screen, enter your username or email, and check your email for. How to Change Insta Password · Type your old password and new password twice. · Tap on Save in iOS and checkmark in Android. Go to login to another account and then click on find my account and it should let you change your password. If you can't log in to your Instagram account email anymore, then you need to use the phone number added to your Instagram account to know instagram password. get your accounts reconnected. Click Continue If your backup included third-party accounts, enter your recovery password when prompted and tap Connect. Visit Accounts Center and select Continue with email. · Enter the confirmation code from your email and click Next. · Click · Select your Meta account, then click. and when receiving a message in one service, you find the platform(s)/service(s) you want to repost the message at and call their SendMessage. Reset your password · Check your email inbox for a password reset email titled “web-forma.online - Your password reset link.” It may take up to 10 minutes to receive. · In. 1. On the login screen, below Log in, tap Get help logging in. · 2. Enter username, email or phone number. · 3. Tap Next, and follow the on-screen instructions.

How do I Change My Password? Enter your username, your old password, new password, and then confirm password (re-enter New password). Select Next to finalize. Anywhere that refers to a "Key Account Login" or a "Username and Password" refers to these credentials. New students and employees will be given their student. Tap Get help with signing in. It's below the blue Log In button next to Forgotten your login details? on an Android. If you are using an iPhone or iPad, look. Visit Accounts Center and select Continue with email. · Enter the confirmation code from your email and click Next. · Click · Select your Meta account, then click. If you're having trouble logging into your Instagram account, you can learn how to do things like recover your Instagram password, confirm your identity or. On the sign-in screen, choose Forgot Password? Enter your discovery+ account email and choose Email Me. Check your inbox for a Reset your password email sent by. How to Change Insta Password · Type your old password and new password twice. · Tap on Save in iOS and checkmark in Android. When using your computer, go to the Instagram website. Click Forgot Password? and enter your username, phone number, or email to get a password reset link. If you know the username, email address, or phone number that's tied to their Instagram account, just hit the Forgot Password link on the Instagram login page. On the login page, tap on "Forgot password?" or "Get help logging in." Then, enter your username, email address, or phone number associated with your account. Open the Instagram app, then at the bottom, tap Forgot password?. Enter your username, then tap Next. At the bottom, tap Can't reset your password? Change your Instagram password · Tap profile · Tap more options · Tap Accounts Center, then tap Password and security. · Tap Change password, then tap the account. Open your mobile browser and go to the Pinterest password reset page · Search for your email, name, or username to find your account · Tap This is me next to your. On the sign-in screen, choose Forgot Password? Enter your discovery+ account email and choose Email Me. Check your inbox for a Reset your password email sent by. If you can't remember the password to your Instagram account, then you can request a password reset email. If password reset isn't working. You can request a. M posts. Discover videos related to How to See Your Old Instagram Password on TikTok. See more videos about How to Disable Saving Instagram Pictures. How to change your IG email without logging into the app · Open the Instagram mobile application, then tap Forgot password? at the bottom of the screen. · Enter. Reset your password · Check your email inbox for a password reset email titled “web-forma.online - Your password reset link.” It may take up to 10 minutes to receive. · In. First, try the “Forgot Password” option on Instagram's app or site. This can lead to a password reset and account access. If you can't get past. get your accounts reconnected. Click Continue If your backup included third-party accounts, enter your recovery password when prompted and tap Connect.

Are Mortgage Brokers A Good Idea

Instead of contacting several lenders yourself, comparing mortgage interest rates and filling out multiple home loan applications, a broker will do all of the. And it's not just those new to the property market. If you're already on the ladder, a broker can still provide essential advice during a stressful time. In my experience, mortgage brokers can always find you a better rate than a local bank. That's what they do. That's ALL they do. As a mortgage broker, it is essential to have a strong, diverse marketing plan in place so that you are able to create a steady stream of new business despite. The first thing to remember is that these brokers are experts, and if you're buying a house – especially for the first time – it's a good idea to take advantage. Instead of contacting several lenders yourself, comparing mortgage interest rates and filling out multiple home loan applications, a broker will do all of the. You'll have access to multiple lenders, which gives you a good idea of how multiple lenders will qualify you. This can give you more flexibility, especially if. Convenience – mortgage brokers have access to the current interest rate deals and save you time contacting each bank to see if you're eligible. They also help. A mortgage broker is a person or institution who plays matchmaker between property buyers and lenders – ie helping borrowers get home loans and helping lenders. Instead of contacting several lenders yourself, comparing mortgage interest rates and filling out multiple home loan applications, a broker will do all of the. And it's not just those new to the property market. If you're already on the ladder, a broker can still provide essential advice during a stressful time. In my experience, mortgage brokers can always find you a better rate than a local bank. That's what they do. That's ALL they do. As a mortgage broker, it is essential to have a strong, diverse marketing plan in place so that you are able to create a steady stream of new business despite. The first thing to remember is that these brokers are experts, and if you're buying a house – especially for the first time – it's a good idea to take advantage. Instead of contacting several lenders yourself, comparing mortgage interest rates and filling out multiple home loan applications, a broker will do all of the. You'll have access to multiple lenders, which gives you a good idea of how multiple lenders will qualify you. This can give you more flexibility, especially if. Convenience – mortgage brokers have access to the current interest rate deals and save you time contacting each bank to see if you're eligible. They also help. A mortgage broker is a person or institution who plays matchmaker between property buyers and lenders – ie helping borrowers get home loans and helping lenders.

So if you're in a lot of debt or you've struggled with credit in the past, you may be better suited to a broker that specialises in poor credit. Some mortgage. A mortgage broker is a licensed professional who can help you find a mortgage loan. Mortgage brokers work with a variety of lenders, so they can compare rates. Based on standard lender guidelines, we'll give you a good idea of what kind of terms and loan program you can expect to benefit from most. Step Two: Pre. For us, the attraction of using a reputable Mortgage Broker is simple. Unlike the banks, it's in a Broker's best interest to do the right thing by their client. Brokers can provide different loan opportunities you otherwise might not find on your own. In certain cases, they can help you obtain a better rate than working. loan and % financing so that i could buy a duplex. she is extremely creative and very helpful. she even helped me figure out that it was not a good idea. Your mortgage broker can improve your chances of acceptance Though it's never guaranteed that you'll get your first choice of mortgage deal, using a mortgage. So if you're in a lot of debt or you've struggled with credit in the past, you may be better suited to a broker that specialises in poor credit. Some mortgage. Mortgage brokers can also sometimes get very good deals, better than you could get going direct to the lender. Who can use a mortgage broker? Anyone getting a. Which one are you more likely to call?? The one that LOOKS legitimate and seems like a business you can trust to get the job done! And good news. Mortgage brokers must act in your best interests when suggesting a loan for you. A good broker works with you to: Understand your needs and goals. Work out what. They're different from bank loan officers who can only offer their employer's limited products and services. On the other hand, mortgage brokers are. Additionally, many mortgage brokers have good relationships with lenders that they frequently refer out business to. For example, you may be quoted at a 5 year. They can also improve your chances of being accepted for a mortgage as they'll know which lenders are best suited to your circumstances. They can be. A mortgage broker is a middleman that compares home loans on your behalf, searching for the best rate and terms. While they can be helpful, their services aren'. A mortgage broker is a licensed professional who can help you find a mortgage loan. Mortgage brokers work with a variety of lenders, so they can compare rates. Yep, they're the middle person between you and a lender — identifying your needs, comparing loans, explaining your options, chatting to lenders, taking care of. But it has been the rise of wholesale lending through mortgage brokers that has made the greatest impact on the home buyer's ability to obtain a home loan. Given how difficult it is to find a reasonable mortgage rate, it will be beneficial to have a professional assistant. The mortgage broker will ease the entire. Buying a house can be tough. The mortgage process can typically take up to 60 hours. That's a lot of work – and that's why it's a good idea to let a.

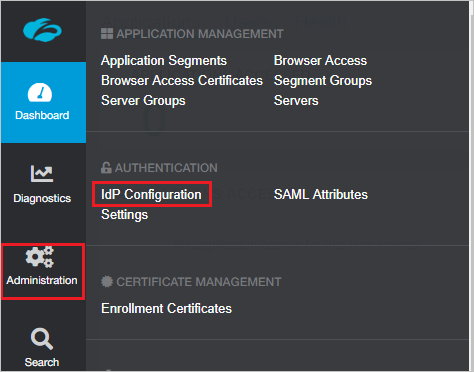

Zscaler B2b

Zscaler for B2B Securing third-party access to IT resources is crucial, yet traditional methods often fall short. Implementing a zero trust. Zscaler is a Information Technology And Services (ITES) based company and has headquarters in San Jose, California, United States. Zscaler B2B allows enterprises to securely collaborate with their customers, suppliers and manufacturers with a cloud-delivered zero trust architecture. Zscaler™, Zscaler Private Access™, and ZPA™ are either (i) registered • Zscaler B2B Pro platform – ZTNA for customers. • Multiple identity provider. Zscaler™, Zscaler Internet Access™, Zscaler Private Access™, ZIA™ and ZPA™ are Zscaler for B2B. Zscaler for IoT / OT. Zscaler for Workloads. 0". Data. Zscaler B2B is a cloud-based service to provide business customers fast, seamless, and secure access to applications over the internet, regardless if they are. With Zscaler for B2B, organizations can minimize the attack surface by hiding IT resources behind the Zero Trust Exchange. It's been a little bit since I've specifically reviewed B2B. But B2B offers functionality like streaming the picture to the browser, so it offer controls for. Zscaler B2B: This product simplifies secure business-to-business interactions by providing authenticated access to applications without exposing them to the web. Zscaler for B2B Securing third-party access to IT resources is crucial, yet traditional methods often fall short. Implementing a zero trust. Zscaler is a Information Technology And Services (ITES) based company and has headquarters in San Jose, California, United States. Zscaler B2B allows enterprises to securely collaborate with their customers, suppliers and manufacturers with a cloud-delivered zero trust architecture. Zscaler™, Zscaler Private Access™, and ZPA™ are either (i) registered • Zscaler B2B Pro platform – ZTNA for customers. • Multiple identity provider. Zscaler™, Zscaler Internet Access™, Zscaler Private Access™, ZIA™ and ZPA™ are Zscaler for B2B. Zscaler for IoT / OT. Zscaler for Workloads. 0". Data. Zscaler B2B is a cloud-based service to provide business customers fast, seamless, and secure access to applications over the internet, regardless if they are. With Zscaler for B2B, organizations can minimize the attack surface by hiding IT resources behind the Zero Trust Exchange. It's been a little bit since I've specifically reviewed B2B. But B2B offers functionality like streaming the picture to the browser, so it offer controls for. Zscaler B2B: This product simplifies secure business-to-business interactions by providing authenticated access to applications without exposing them to the web.

Responsible for securing more than of the Forbes Global companies, Zscaler Zero trust from office to data centre; B2B customer app access. Find. With secure and ready access to the critical business systems and applications they need. . Zscaler goes about securing your business as well as improving the. B2B App Segments for subscribed users that enables customers to buy ZPA/B2B App ZPA Business Suite: Annual subscription to Zscaler Private Access Business. Explore Zscaler Business Development JOBS hiring near you! Browse our 22+ job postings and take the first step towards your career success Today! Zscaler B2B provides secure and reliable access to B2B apps for your business customers. ZTNA framework ensures only authorized customers can access. • Zscaler Workload Segmentation (ZWS). • Zscaler B2B Pro Platform. • Multiple identity provider support. • Double encryption with customer-provided PKI. • ZPA. Zscaler Work from Anywhere Business Edition, Annual subscription ZIA Business Edition and ZPA Business Edition with an additional ZPA Private Service Edge. Zscaler B2B vs Zscaler Zero Trust Exchange: which is better? Base your decision on 29 verified in-depth peer reviews and ratings, pros & cons, pricing. SCHNEIDER. SERVICENOW. SOFTWARE AG. SPLUNK. ADOBE. ADARMA V2. TANIUM. ZSCALER. ADP. AMEX. AUTOSTORE. CISCO. EY. ENFUCE. DILIGENT. DARKTRACE. FORTINET. FUJITSU. Zscaler, creator of the Zero Trust Exchange platform, uses the largest security cloud on the planet to make doing business and navigating change a simpler. Zscaler B2B (ZB2B) is a cloud service that provides your business customers fast, seamless, and secure access to applications over the internet. The Zscaler Help Portal provides technical documentation and release notes for all Zscaler services and apps, as well as links to various tools and. engagement and user retention data for 7+ million apps in 60+ countries. Request a Demo. App Icon. Zscaler B2B. iOS App Store; Free; Zscaler Inc · Productivity. Zscaler B2B, Zscaler Cloud Protection, and Zscaler Digital Experience. The company was founded by Jagtar Singh Chaudhry and K. Kailash in September and. It's been a little bit since I've specifically reviewed B2B. But B2B offers functionality like streaming the picture to the browser, so it offer controls for. Zscaler is a leading cloud security company headquartered in San Jose, California. Other products include Zscaler Digital Experience and Zscaler B2B. Vendr. B2B App segments. Limited to system max Zscaler Annual subscription to Business, restricted to Education Customers exclusively using ZIA Service Edge. Zscaler | followers on LinkedIn. We make it easy to secure your cloud transformation. Get fast, secure, and direct access to apps without appliances. Zscaler. Zero Trust Exchange. Zscaler Internet Access. ZIA. Zscaler Private Access. ZPA. Zscaler Digital Experience. ZDX. Zscaler B2B. Direct-to-Cloud. Shift. It offers Zero Trust Exchange, Zscaler Client Connector, Zscaler Internet Access, Zscaler Private Access, Zscaler B2B, Zscaler Cloud Protection, and Zscaler.

Hdfc Mortgage Loan

Loans are secured by a valid first mortgage on the land and building owned by the borrower · LES People's FCU will lend up to 75% of the appraised value of the. You can easily secure a Loan by mortgaging your property. Your property can help fulfil your dreams. Avail a mortgage loans at lower interest rates. Raise funds easily and quickly with loans against residential and commercial properties. Calculate your EMI & adjust the loan tenure for a convenient repayment. mortgage closure / fresh creation or any other hidden expenses). Do a detailed calculation and if still entails significant savi. Continue. Mortgage loans · Private banking · Private equity · Investment management · Asset management · Mutual funds · Exchange-traded funds · Index funds · Wealth. The borrowers can avail this loan by mortgaging their property as security with the bank. The fund which is generated from this can be used for any kind of. Avail easy home loans to buy a property or remodel an existing house; Get help from legal and technical experts every step of the way; Enjoy attractive. HDFC Bank Home Loans Mobile App is a one stop shop for all the informational and transactional services related to loans, around your home, with HDFC Bank. Apply for MSME loan against property & get instant loan approval. Get up to 65% of the value of your property as a loan to fund all the business financial. Loans are secured by a valid first mortgage on the land and building owned by the borrower · LES People's FCU will lend up to 75% of the appraised value of the. You can easily secure a Loan by mortgaging your property. Your property can help fulfil your dreams. Avail a mortgage loans at lower interest rates. Raise funds easily and quickly with loans against residential and commercial properties. Calculate your EMI & adjust the loan tenure for a convenient repayment. mortgage closure / fresh creation or any other hidden expenses). Do a detailed calculation and if still entails significant savi. Continue. Mortgage loans · Private banking · Private equity · Investment management · Asset management · Mutual funds · Exchange-traded funds · Index funds · Wealth. The borrowers can avail this loan by mortgaging their property as security with the bank. The fund which is generated from this can be used for any kind of. Avail easy home loans to buy a property or remodel an existing house; Get help from legal and technical experts every step of the way; Enjoy attractive. HDFC Bank Home Loans Mobile App is a one stop shop for all the informational and transactional services related to loans, around your home, with HDFC Bank. Apply for MSME loan against property & get instant loan approval. Get up to 65% of the value of your property as a loan to fund all the business financial.

Quick and seamless approval: With a clearly defined documentation requirement, HDFC Bank Overdraft Against Property approval is a quick and seamless process. HDFC Mortgage Loans near New York Public School Salt Lake City Sector 3. Find ✓Loan Against Property, ✓HDFC Property Loans, ✓HDFC Housing Loan, ✓HDFC Loan. Loan against fully constructed, freehold residential and commercial properties for: Business Needs; Marriage, medical expenses and other personal needs;. *Terms and conditions apply. Home Loan at the sole discretion of HDFC Bank Limited. Loan disbursal is subject to documentation and verification as per Banks. With HDFC Bank Home Loans turning your dream home in India, into a reality, is convenient and easy. Loans to NRIs, PIOs and OCIs* for the purchase of a flat. A Mortgage Loan Calculator is a financial tool that helps you to determine your EMI based on your loan amount, interest rate and tenure. Loans, Commercial / Construction Equipment Loans, Two Wheeler Loans and Loan Against Property. Kindly enter the details as provided in the Loan Application Form. Loan Against Property Eligibility Details · Age. years · Profession. Salaried / Self Employed · Nationality. Resident Indian · Tenure. Upto 15 years. HDFC Mortgage Loan EMI Calculator to Estimate the EMI that Fits Your Budget. Use the HDFC Loan against Property EMI calculator to input various loan amounts. Loan Amount: The minimum loan amount HDFC Bank offers under mortgage loan is Rs. 10 lakhs and maximum amount up to Rs. 20 crores depending on value of the. HDFC Bank Loan against Property Interest Rate ; Property type. Interest Rates ; Loan against Property / Loan for Commercial Property. % to % ; Loan. web-forma.online under Net Banking login choosing Option for Retail. Loan Acknowledgement for Secured Loan Application - Mortgages. CONTACT US. Name of. Get an instant top-up on your existing car loan of up to % of its value. The HDFC Bank Mortgage Loan in Chennai is the right decision to opt for home loans as the bank rightly analyses your exact financial needs and provides. A home loan statement summarises your loan repayment in a financial year. Get details of your housing loan repayment income tax deductions with HDFC Bank. HDFC Bank provides loans against property for loan tenures of up to 15 years. Interest rates up to % is provided. Get hassle-free documentation and loans. HDFC Home Loan Calculator: Calculate HDFC Home Loan EMI Online For security, one can keep the mortgage on the property they are planning to buy, renovate or. Mortgage web-forma.onlinesing the home of your dreams is not an easy task. Especially when you plan to buy a home on loan. Home loan means that you. The purpose of the HDFC program is to provide loans to nonprofit organizations to develop low-income housing projects. Loan against fully constructed, freehold residential and commercial properties for: Business Needs; Marriage, medical expenses and other personal needs;.

Student Credit Card Deals

Our Platinum Mastercard is not only a great fit for those looking for a low-interest rate, it's the perfect credit card for students. CASE U Visa Card · Low rate of % APR · No annual fee · No balance transfer fee · No cash advance fee · Free instant card issue · Fraud protection services. From travel and cash rewards to a lower interest rate, we have credit cards for students with a variety of features. Learn more with our comparison tool. Many credit card issuers offer cards designed specifically for college students with limited to no credit history. Student credit cards can help young. Our Starter/Student Card has a credit limit up to $2, and is for members Visa Credit Card Discounts. Find great deals on brands you love when you. Student credit cards are designed for student borrowers looking to build their credit history. · Because student borrowers generally have little or no credit. Quicksilver Rewards for Students allows qualifying students to earn unlimited % cash back on all purchases and a one-time $50 cash bonus after spending $ Student credit cards are a great way for young Most of the major credit card issuers offer credit cards that are specifically designed for students. Best for rotating bonus categories: Discover it® Student Cash Back Here's why: This card offers a great cash back rate on rotating categories, but you have to. Our Platinum Mastercard is not only a great fit for those looking for a low-interest rate, it's the perfect credit card for students. CASE U Visa Card · Low rate of % APR · No annual fee · No balance transfer fee · No cash advance fee · Free instant card issue · Fraud protection services. From travel and cash rewards to a lower interest rate, we have credit cards for students with a variety of features. Learn more with our comparison tool. Many credit card issuers offer cards designed specifically for college students with limited to no credit history. Student credit cards can help young. Our Starter/Student Card has a credit limit up to $2, and is for members Visa Credit Card Discounts. Find great deals on brands you love when you. Student credit cards are designed for student borrowers looking to build their credit history. · Because student borrowers generally have little or no credit. Quicksilver Rewards for Students allows qualifying students to earn unlimited % cash back on all purchases and a one-time $50 cash bonus after spending $ Student credit cards are a great way for young Most of the major credit card issuers offer credit cards that are specifically designed for students. Best for rotating bonus categories: Discover it® Student Cash Back Here's why: This card offers a great cash back rate on rotating categories, but you have to.

Chase does not offer student credit cards. However, Chase Freedom Rise℠ is likely a card for people new to credit cards, including students, that offers %. Best Credit Card for Students? · No annual fee (great for keeping open into adulthood to anchor your age of credit) · No foreign transaction fee &. 10 Best Student Credit Cards · 1. Chase Freedom Student Credit Card · 2. Discover It Student Cash Back Card · 3. Capital One Quicksilver Rewards for Students. The cashback reward amount will be $ if redeemed towards student loans with an eligible servicer. The cashback reward amount will be $ if redeemed for a. Best student credit cards of September ; Capital One SavorOne Student Cash Rewards Credit Card · · on Capital One's secure site · $50 · 1% - 8%. With a student credit card, teens can start building a credit score. A good credit score can help them get a lower deposit on an apartment and better rates on. Capital One offers a student version of its dining rewards credit card, and the maximum-reward categories may fit well into a typical college student's budget. The Teachers Student Visa Credit Card is a low balance card ideal for college students who are just starting to build their credit. Student benefits: Student credit cards may give you the opportunity to make use of special student perks. For example, some cards may offer higher cash back. PNC Cash Rewards® Visa® Credit Card · You'll receive a $ Bonus after you make $1, or more in purchases during the first 3 months following account opening. Some student credit cards may waive annual fees and may offer reward programs that allow you to earn points and cash back on certain purchases. When researching. Find out more about the rules and credit card options available for students by reading expert reviews, articles and ratings. The best Chase credit card for college students is the Chase Freedom Rise® card, since it accepts applicants with limited credit history and earns % cash. Our Platinum Mastercard is not only a great fit for those looking for a low-interest rate, it's the perfect credit card for students. 2. Capital One Quicksilver Student Cash Rewards Credit Card · $0 annual fee · Earn a flat % on all purchases (unlimited) · Get 10% cash back on Uber & Uber Eats. 10 Best Student Credit Cards · 1. Chase Freedom Student Credit Card · 2. Discover It Student Cash Back Card · 3. Capital One Quicksilver Rewards for Students. Best Student Credit Cards of September · Discover it® Student Cash Back · Discover it® Student Chrome · Bank of America® Customized Cash Rewards credit card. Your first credit card comes with a lot of excitement and plenty of attractive benefits. Our Student Mastercard® helps you spend wisely, enhanced by an. With a Bank of America® Cash Rewards credit card for students you earn 3% cash back in the category of your choice: gas, online shopping, dining, travel. In addition to the cashback earning potential, the student card comes with a promotional offer of 0% APR for 6 months on purchases plus % APR on balance.

What Are Closing Costs On A House In Texas

CC are title and escrow fees only. Buy downs, repairs, credits, warranties are not part of closing costs. Those are credits & adjustments. Home Buying Guide: Average Closing Costs Houston. Complete guide to determine your Houston home's average closing cost. However, as a general rule, you can expect your closing costs to be between 2% and 7% of the home's purchase price. Are Closing Costs Different. All the Home Buying Costs Explained ; Total Closing Costs. $ ; TOTAL TO PURCHASE HOME ; Down Payment. $18, ; Earnest Money, Option Fee, Inspections. $ Use this Texas Mortgage Closing Cost Calculator to estimate the total funds needed for closing expenses when purchasing a home with a mortgage. Use this calculator to determine how much you should expect to pay in closing costs on your home loan. Use SmartAsset's award-winning calculator to figure out your closing costs when buying a home. We use local tax and fee data to find you savings. We'll group closing costs as follows: lender fees, title company fees, other services provider fees, government fees, mortgage insurance, and other fees. Estimate your closing costs · Points. Money paid to the lender, usually at mortgage closing, in order to lower the interest rate. · Mortgage insurance. For. CC are title and escrow fees only. Buy downs, repairs, credits, warranties are not part of closing costs. Those are credits & adjustments. Home Buying Guide: Average Closing Costs Houston. Complete guide to determine your Houston home's average closing cost. However, as a general rule, you can expect your closing costs to be between 2% and 7% of the home's purchase price. Are Closing Costs Different. All the Home Buying Costs Explained ; Total Closing Costs. $ ; TOTAL TO PURCHASE HOME ; Down Payment. $18, ; Earnest Money, Option Fee, Inspections. $ Use this Texas Mortgage Closing Cost Calculator to estimate the total funds needed for closing expenses when purchasing a home with a mortgage. Use this calculator to determine how much you should expect to pay in closing costs on your home loan. Use SmartAsset's award-winning calculator to figure out your closing costs when buying a home. We use local tax and fee data to find you savings. We'll group closing costs as follows: lender fees, title company fees, other services provider fees, government fees, mortgage insurance, and other fees. Estimate your closing costs · Points. Money paid to the lender, usually at mortgage closing, in order to lower the interest rate. · Mortgage insurance. For.

The average home buyer in Texas spends between $24, and $86, when purchasing a $, home — the state median value. Keep in mind, this is just the. The average home buyer in Texas spends between $24, and $86, when purchasing a $, home — the state median value. Keep in mind, this is just the. Texas no closing costs mortgage pros There are no upfront costs associated with the loan. It means that you will not have to pay any origination fees. These costs can add up quickly and usually range from % of the property's sale price. While the payout of some closing costs are negotiable between seller. The average closing costs for buyers in Texas are approximately 2% to 5% of the purchase price, with a good rule of thumb of 3% for a quick ballpark estimate. Usually purchased in a bundle with the owner's title insurance. This cost is a one-time fee usually between % – % of the sale price. For example, a. Closing costs usually cover fees related to the origination and underwriting of a loan, real estate commissions, insurance, property taxes, and transaction. Learn about closing costs in Texas whether you are a buyer or a seller - HOA fees, property taxes, Title Insurance Policy, Documentation Fee, survey fee. Generally speaking, for a new home purchase in Texas, the buyer can expect to pay around % (of the purchase price) for closing costs and prepaid escrow. Average closing costs for the buyer run between about 2% and 5% of the loan amount. That means, on a $, home purchase, you would pay from $6, to. Typically, home buyers will pay between about 2 to 5 percent of the purchase price of their home in closing fees. So, if your home cost $,, you might pay. Typically, home buyers will pay between about 2 to 5 percent of the purchase price of their home in closing fees. In a nutshell, the closing costs for home buyers include expenses associated with obtaining a loan, expenses related to the property, and service fees. It's. Closing costs are the expenses that both buyers and sellers have in a real estate transaction. In simpler terms, if you're buying a home, closing costs will be. In a nutshell, closing costs are legal and transaction fees associated with the purchase of a home. You can expect the following fees: application fee. TX broker here. It's best to budget 3% of your purchase price for closing costs. I usually try to negotiate closing costs be covered by sellers. Other Costs To Consider When Buying Land in Texas · Home insurance · Utilities · Maintenance · Property taxes. In Texas, the average buyer's closing cost will usually be between 2 and 6% of the contract price for a home. The average closing costs percentage is usually about % of the purchase price, but % is not uncommon. Use this calculator to estimate your total closing. A homebuyer can expect to see closing costs between $6, to $9, What Makes Up Closing Costs? The closing total is an amalgamation of several fees and.

What Is Lowest 30 Year Mortgage Rate

Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Mortgage rates as of August 30, year fixed; year fixed; 7/1 ARM; 3/1 Should I pay points to lower the rate? What will my closing costs be. Today's year mortgage rates can be customized from major lenders. NerdWallet's 30 yr mortgage rates are based on a daily survey of national lenders. See your personalized rates for a year, fixed-rate mortgage by providing answers to a few questions below. You may even qualify for a lower rate. Interactive historical chart showing the 30 year fixed rate mortgage average in the United States since The current 30 year mortgage fixed rate as of. The current average year fixed mortgage rate climbed 2 basis points from % to % on Monday, Zillow announced. The year fixed mortgage rate on. The best year mortgage rates are usually lower than 4%, and the average mortgage rate nationally on a year fixed mortgage is % as of January View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Currently, the year mortgage rate is at %, compared to % last week and % last year. Overall, this is lower than the long-term average of %. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Mortgage rates as of August 30, year fixed; year fixed; 7/1 ARM; 3/1 Should I pay points to lower the rate? What will my closing costs be. Today's year mortgage rates can be customized from major lenders. NerdWallet's 30 yr mortgage rates are based on a daily survey of national lenders. See your personalized rates for a year, fixed-rate mortgage by providing answers to a few questions below. You may even qualify for a lower rate. Interactive historical chart showing the 30 year fixed rate mortgage average in the United States since The current 30 year mortgage fixed rate as of. The current average year fixed mortgage rate climbed 2 basis points from % to % on Monday, Zillow announced. The year fixed mortgage rate on. The best year mortgage rates are usually lower than 4%, and the average mortgage rate nationally on a year fixed mortgage is % as of January View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Currently, the year mortgage rate is at %, compared to % last week and % last year. Overall, this is lower than the long-term average of %.

What is a year fixed-rate mortgage? A loan used for purchasing or refinancing a home with an interest rate that never changes and a repayment term of thirty. year mortgage rates currently average % for purchase loans and % for refinance loans. Find your best mortgage rates · Get the lowest. Average year mortgage rate up to % · Mortgage rates may be heading higher · Mortgage rates fall, year fixed at record · Average year mortgage rate. What is a Year Fixed Mortgage Rate? A mortgage rate is the interest rate you pay on your mortgage loan. Mortgage rates change daily and are based on. Today's rates for year fixed-rate mortgages are in the upper 6% to low 7% range for buyers with excellent credit. How Can I Find. The average contract interest rate for year fixed-rate mortgages with conforming loan balances ($, or less) edged 1bps lower to % in the week ended. Just curious what some people have out there in terms of low interest rates. I was able to negotiate down to % last year. National year fixed mortgage rates go up to %. The current average year fixed mortgage rate climbed 2 basis points from % to % on Monday. Mortgage points, or discount points, are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. For example, in , the average interest rate on a year home loan was %. In , it was % and 20 years later, in , the annual average. The average rate on a year fixed mortgage remained relatively stable at % as of August 29, marking its lowest level since mid-May , according to. At the time of writing, the lowest year mortgage rate ever was % (according to Freddie Mac's weekly rate survey). That number may have changed since. And. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. The 30 Year Mortgage. As of Aug. 30, , the average year fixed mortgage rate is %, year fixed mortgage rate is %, year fixed mortgage rate is %. Comparing current year mortgage rates ; LENDER. Navy Federal. INTEREST RATE, % ; Wells Fargo. % ; LENDER. Wells Fargo. INTEREST RATE, % ; Rocket. Shorter-term mortgages, like 15 year terms, often come with lower interest What is the current mortgage rate? Today's year fixed mortgage rate in. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. On a $, mortgage, you would. Mortgage rates by loan term ; year fixed rate. %. % ; year fixed rate. %. % ; year fixed rate. %. % ; year fixed.

How To Make Fast Income

An increasingly popular way to make money online is to fill out online surveys in their spare time. Research companies are always recruiting new. Apple Music pays artists just one penny per stream in royalties, so you'd need to get hundreds of thousands of listeners per month to make a decent income. That. 25+ Ways to Make Quick Money in One Day · 1. Become a rideshare driver · 2. Focus on freelancing · 3. Sell unused gift cards · 4. Carsharing or parking spot. Tech professionals can make extra money with minimal routine work by developing an app, writing an e-book, or creating a technology course. Solutions for your goal · Steps to earn money · Qualify for monetization · Optimize your content · Make ads work for you · Show your community how to support you. You can start earning money with your tech skills without a computer science degree or 15, 5, or even 1 year of experience. How to make money fast · 1. Find out if you have unclaimed property · 2. Sell unused gift cards · 3. Trade in old electronics · 4. Take surveys. If you're shrewd, you can turn one thousand bucks into even more money. Here's how to make money on investments, even small ones. 25+ Ways to Make Quick Money in One Day · 1. Become a rideshare driver · 2. Focus on freelancing · 3. Sell unused gift cards · 4. Carsharing or parking spot. An increasingly popular way to make money online is to fill out online surveys in their spare time. Research companies are always recruiting new. Apple Music pays artists just one penny per stream in royalties, so you'd need to get hundreds of thousands of listeners per month to make a decent income. That. 25+ Ways to Make Quick Money in One Day · 1. Become a rideshare driver · 2. Focus on freelancing · 3. Sell unused gift cards · 4. Carsharing or parking spot. Tech professionals can make extra money with minimal routine work by developing an app, writing an e-book, or creating a technology course. Solutions for your goal · Steps to earn money · Qualify for monetization · Optimize your content · Make ads work for you · Show your community how to support you. You can start earning money with your tech skills without a computer science degree or 15, 5, or even 1 year of experience. How to make money fast · 1. Find out if you have unclaimed property · 2. Sell unused gift cards · 3. Trade in old electronics · 4. Take surveys. If you're shrewd, you can turn one thousand bucks into even more money. Here's how to make money on investments, even small ones. 25+ Ways to Make Quick Money in One Day · 1. Become a rideshare driver · 2. Focus on freelancing · 3. Sell unused gift cards · 4. Carsharing or parking spot.

For the purchases you may be already making — like on groceries, food delivery or streaming — you could earn cash back. That way, you're not leaving any money. You can work toward achieving it by looking for creative ways to make more money. Here are seven ways to increase your income. If you invest some time and/or money to grow, you can make a few thousands per month completely passively. Here are a few online businesses currently available. You can make money by running errands via digital delivery platforms, such as delivering restaurant meals to people or shopping for groceries and dropping them. If you need to make money quickly online, try Fiverr or Upwork. Many people have earned money there by offering services like writing, graphic. This article will discuss some of the best apps to earn money, whether it be extra cash or full-time income. SELL UNWANTED ITEMS ONLINE FOR EXTRA CASH: An easy way to make easy money without the commitment of a job is by selling gently used items you no longer need or. Earning extra money from home can be achieved through part-time remote work, freelancing, or launching a side hustle. Explore areas like content creation. Best Websites to Make Money Online · 1. Amazon's Kindle Direct Publishing · 2. Fine Art America · 3. Fiverr · 4. Upwork · 5. Rover · 6. Etsy · 7. TaskRabbit · 8. Merch. make money online fast and how you can start earning income on the internet fast today. If you're looking for work from home jobs or online jobs, make sure. Online Surveys: Sign up for survey sites like Swagbucks or Survey Junkie. You can complete surveys in minutes and earn cash or gift cards. 7 Smart Ways to Raise Cash Fast · 1. Liquidate Your Assets · 2. Take on Odd Jobs · 3. Track Down Loose Change · 4. Organize a Garage Sale · 5. Tap Your Retirement. Boost your income · Flog on eBay for best prices · Sell on Vinted with no fees · Sell for free on Facebook · Get quick cash for old CDs, games & more · Flog tech '. You can do it anytime, tasks are simple and best of all it's an easy, quick and fun way to make money! No giftcards or discounts, you are paid cash! HOW. You might do bigger things like starting a blog or investing. You might do online tasks or even make real money playing games. Or you can use cash-back apps or. If you want to make money online fast and receive it upfront, consider selling second-hand items. From T-shirts to furniture, find all the neat items you. Fiverr is the best place to make money online for free. This website lets you offer any kind of service that you are good at and earn money from it. Getting. Turn a hobby or a passion into a new income stream so the extra work feels really intuitive to you. Create your own website on a platform like Wix or list your. We've compiled some of the best ways you can make quick money from your computer, tablet, or phone. Your blood or plasma can bring in a decent profit since you can usually donate twice a week, making between $25 to $50 per donation. You can give blood or.

When Should I Take Collision Off My Car

A collision with an object, such as a fence, tree or guardrail; A single-car accident that involves rolling or falling over. NOT COVERED: Damage to your vehicle. Collision coverage isn't required by law, so if your vehicle is older or has a value equal or almost equal to your deductible, you may decide not to carry. Some experts also advise dropping collision insurance when the vehicle is more than 10 years old. Since the average driver gets into an accident once every Collision coverage pays to repair or replace your vehicle after an accident. While not required by state law, you may be required to purchase collision coverage. It's best to take pictures of the damage and check your policy for details like your collision coverage deductible. If your deductible is less than the cost of. Comprehensive car insurance is a coverage that helps pay to replace or repair your vehicle if it's stolen or damaged in an incident that's not a collision. Collision coverage is typically required if you owe money on your auto loan or if you lease your vehicle, but if your car is paid off, it's optional. Have any. However, if your car is not fully paid off, your lender or lessor may require you to have it. Regardless, insuring your car against collision-related damages is. However, if you own your car then you have the option of removing it. When considering if you should choose collision coverage or not, take these three factors. A collision with an object, such as a fence, tree or guardrail; A single-car accident that involves rolling or falling over. NOT COVERED: Damage to your vehicle. Collision coverage isn't required by law, so if your vehicle is older or has a value equal or almost equal to your deductible, you may decide not to carry. Some experts also advise dropping collision insurance when the vehicle is more than 10 years old. Since the average driver gets into an accident once every Collision coverage pays to repair or replace your vehicle after an accident. While not required by state law, you may be required to purchase collision coverage. It's best to take pictures of the damage and check your policy for details like your collision coverage deductible. If your deductible is less than the cost of. Comprehensive car insurance is a coverage that helps pay to replace or repair your vehicle if it's stolen or damaged in an incident that's not a collision. Collision coverage is typically required if you owe money on your auto loan or if you lease your vehicle, but if your car is paid off, it's optional. Have any. However, if your car is not fully paid off, your lender or lessor may require you to have it. Regardless, insuring your car against collision-related damages is. However, if you own your car then you have the option of removing it. When considering if you should choose collision coverage or not, take these three factors.

Collision insurance is the trickier coverage for older vehicles because it pays for damages sustained to your own vehicle if you're at fault in an auto accident. Most lenders require collision coverage when you lease or finance your vehicle. If you've paid off your car, this coverage may be optional on your car insurance. Comprehensive coverage and collision coverage can be used to help repair the damages caused to your vehicle in an accident. Both coverages have a deductible you. Ask yourself, in the event your car is completely destroyed in an accident, can you afford to replace your car? If the answer is “no” then collision coverage is. For collision, 10 years is a decent rule of thumb. In terms of hard numbers, when the amount you will receive (value of the car minus the. If your car has been deemed total loss, your new vehicle could take the place of your old one under your policy. If you don't find a new vehicle, your old. If you drive an older car that would not cost much to replace, you may have reason to forego buying collision coverage. If your vehicle still has a high value. Comprehensive car insurance is a coverage that helps pay to replace or repair your vehicle if it's stolen or damaged in an incident that's not a collision. Liability, Collision, & Comprehensive Coverage · You got a · Collision coverage helps to pay to repair your vehicle or get one of equivalent cash value if. Collision insurance generally covers damage to your vehicle after an accident. If you're involved in a serious accident where your car is totaled, and you have. Do I Need Collision Insurance? You need collision insurance if your car is not fully paid off and your lender or lessor requires it. If you fail to purchase. For everyone else, the general rule of thumb is: if your car is older than ten years, consider removing your collision coverage. But remember to decide for. You can probably live without collision coverage if you can afford to pay for a new car after an accident, you drive a car worth less than your collision. People with newer cars often keep collision coverage to protect their investments – even if your car loan is paid off. That does not mean it is always in your. Collision coverage helps repair your car from traffic accident damages. Comprehensive coverage pays losses from non-collision incidents like fires or theft. No matter how old your car is, you need collision insurance if you have an auto loan or lease. But what if you're not leasing your vehicle, and your loan. The terms of the rental agreement make the customer responsible for collision damage while he or she has possession of the vehicle. Consumers should take note. If you finance or lease your vehicle, your lender may require you to carry comprehensive and collision. 3 min to read. Explore Progressive Answers' auto. Collision coverage helps pay for the cost of repairs to your vehicle if it's hit by another vehicle. It may also help with the cost of repairs if you hit. Collision insurance and comprehensive insurance are optional. 3. What does physical damage insurance cover? Collision and comprehensive insurance pay for the.

1 2 3 4 5 6